Advantages to TSP Rollovers – Armor up for a great retirement!

As we snuggle up to December here in the Carolinas, we find ourselves enveloped in chilly temperatures, yet snow remains elusive – where’s the snow?! This month is a wonderful time to gather with friends and family, celebrating the warmth of Christmas with those we cherish…or at least tolerate. It’s the perfect time to reflect on what we’re grateful for while enjoying hearty meals and cozy gatherings. Whether you’re sipping a warm beverage (whatever that is I don’t know because they shut down my pumpkin-spiced lattes) or diving into some of Emily’s soul-satisfying Sausage & Rice skillet meal, be sure to take a moment to throw on a layer of financial armor. This month’s ARTICLE and VIDEO – below – provides some valuable guidance on TSP Rollovers. Get after it and ensure that you are taking steps to protect your financial security this season!

But first, get that Sausage & Rice Skillet cooking:

(Courtesy of: Emily Hillard)

Meanwhile, if you know other Federal Agents or Front-Liners that face financial pain points, feel free to pass this on – we’re all in the Battle for Financial Independence together! TSP Rollover Advantages You must start to believe that you are UNSTOPPABLE in the Battle for Financial Independence!

CXO Question of the Month:

Tucker, CXO Chief Experience Officer

Relax. Lay around. And ponder this…

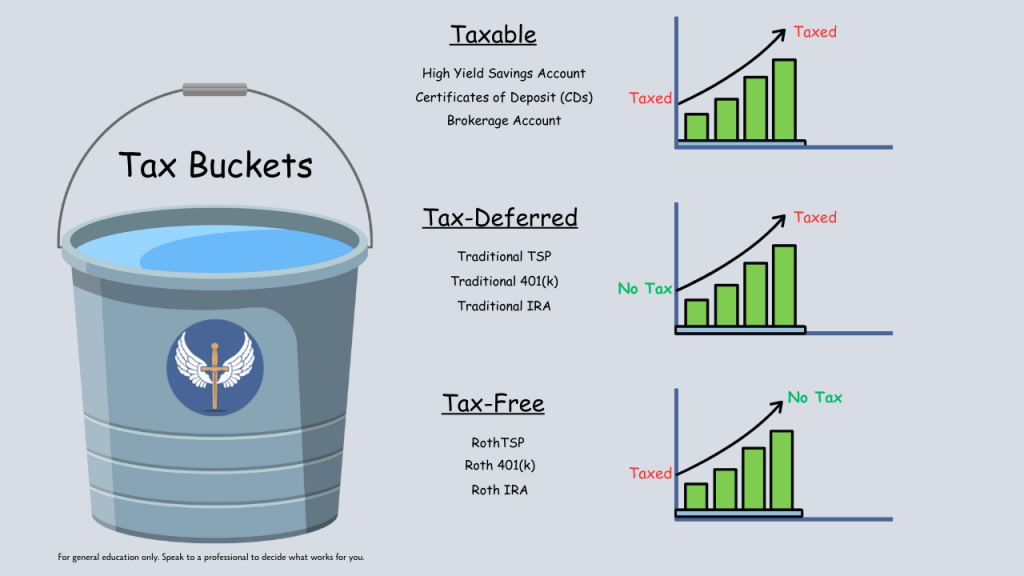

What are the different tax buckets and which accounts go in each?

Answer: First, “a picture is worth…”

Taxable Bucket:

Examples of what’s possibly in it:

High Yield Savings Accounts, Certificates of Deposit (CDs) and Brokerage Accounts (at places such as Charles Schwab for instance – just sayin’). No special tax treatment here. The investments inside of these accounts may earn interest or dividends, or you may experience a gain on securities that you sell. This type of income or gain is taxable in the year it’s realized. A specific example would be a bank savings account that earns interest. The IRS will be on your doorstep in no time when this happens, so save some leftover Christmas cookies and milk for them!

Tax-Deferred Bucket:

Examples of what’s possibly in it:

Traditional TSP, Traditional 401(k), and a Traditional IRA (the latter of which we can open for you at Charles Schwab <– see what I did there). These “traditional” accounts are often referred to as “pre-tax”. You contribute into these accounts and you don’t have to pay taxes until later down the road when you withdraw the money. Subsequently, the investments in these accounts may also earn interest or dividends, or you may experience a gain on securities that are sold inside of the accounts. Remember, the TSP, a 401(k) and an IRA are accounts. It’s the investments inside of these accounts that are doing the heavy lifting of earning money. A specific example would be if you make a contribution of $1,000 to your Traditional IRA. You won’t pay taxes on the $1,000 right now. The IRS will pass right by your doorstep, but they won’t forget that you owe them taxes…and leftover Christmas cookies and milk!

Taxable-Free Bucket:

Examples of what’s possibly in it:

Roth TSP, Roth 401(k), and a Roth IRA (no shameless plug for our pal “Chuck” here). You contribute into these accounts with money that you’ve already paid taxes on. Later down the road when you withdraw the money, you won’t owe any taxes. Not a dime (provided you follow the general rules of the account of course). Subsequently, the investments in these accounts may also earn interest or dividends, or you may experience a gain on securities that are sold inside of the accounts. A specific example would be if you make a contribution of $1,000 to your Roth IRA. You will pay taxes on the $1,000 right now. But after years of tax-free growth, you can also then take withdrawals tax-free (provided you follow the general rules of the account again of course). Yep, the IRS was already paid when you made the contribution so now they will pass right by your doorstep…and they won’t ask for any taxes or Christmas cookies or milk!

In Other News:

Interested in help with your investments?

We custody with Charles Schwab so we are able to open and manage various investment accounts that are most needed by our Federal Agents and FrontLiners:

- Money Market Funds (for cash storage!)

- Taxable Brokerage accounts (for short or long term goals!)

- Traditional & Roth IRAs (retirement savings beyond your TSP!)

- Trust accounts (one of our favorites!)

May you have a safe, snowy and adventurous December with family and friends! Have some Sausage & Rice Skillet while building your financial armor and throw some snowballs at the kids…or the neighbors. Take some time to be grateful for your blessings and don’t hesitate to do a “10-4 check” on a friend. Cheers!

Be the Hero for You and Yours!